Top 10 stocks to buy this week which could give up to 40% return in short term

|

| Top 10 stocks to buy this week |

The trend seems to be on the upside and the ideal strategy is to buy on dips just like we saw on Friday when market witnessed mild profit booking decline which was quickly bought into

Kshitij Anand

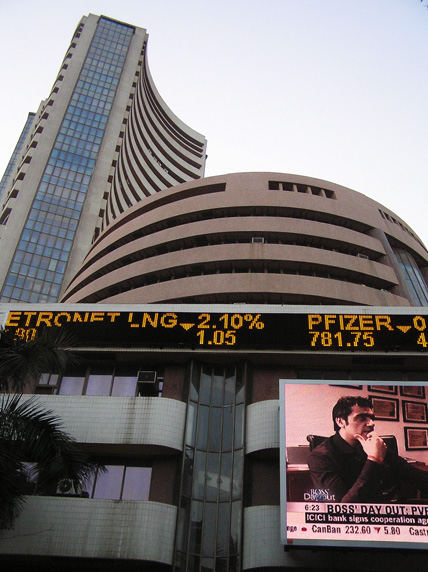

The Nifty50 index rose to fresh record highs last week and came closer to its next crucial resistance level of 10,700. The index closed with gains of 1.1 percent for the week ending January 12, however, the coming week is likely to be volatile.

The trend seems to be on the upside and the ideal strategy is to buy on dips just like we saw on Friday when market witnessed mild profit booking decline which was quickly bought into.

But, some of the indicators are giving indications of Nifty being in an overbought zone and profit booking decline is possible ahead of the budget. Investors should maintain their long positions as long as 10,550 remains intact.

“We had highlighted that the index is not finding similar sort of strength if manages to breakout in the upward direction. Also, the possibility of volatility increasing was on the cards. All these factors were seen during the session and due to smart recovery, the Nifty eventually ended the week on a high note,” Sameet Chavan, Chief Analyst- Technical & Derivatives, Angel Broking Pvt Ltd told Moneycontrol.

Will maintain bancassurance and agency distribution mix: Pankaj Razdan, Aditya Birla Sun Life Insurance

CCI clears Zydus Wellness' share sale of Rs 2,575 cr to Cadilla Healthcare, 3 others

“The way index smartly recovered is generally considered as a good sign; but, due to wild swings, we can now see a copybook formation of ‘Dragonfly Doji’ on the daily chart. The said pattern at higher levels does not bode well and hence, one needs to be closely tracking how markets behave in the first half of the week,” he said.

Chavan further added that markets are reluctant to fall; we would rather wait for a confirmation to happen. The pattern will get activated below its low i.e. 10597 and hence, any sustainable move below this key support would extend further weakness in days to come.

We have collated a list of ten stocks which could give up to 40% return in the short term:

Brokerage: SMC Capital

Cholamandalam Investment and Finance Company Ltd: BUY | Target Rs 1440| Stop Loss Rs 1230| 1-2 months| Return 10%

The stock closed at Rs 1310.80 on 12th January 2018. It made a 52-week low at Rs 912 on the 10th March 2017 and a 52-week high of Rs 1353.80 on 8th January 2018. The 200-days Exponential Moving Average (EMA) of the stock on the daily chart is currently at Rs 1167.13.

The short-term, medium term and long term bias look positive for the stock. The stock had witnessed a decent upside from Rs 1150 to Rs 1300 levels in a week and had consolidated in Rs 1250-1320 levels for eight weeks.

The stock now has formed a “Bull Flag” pattern on weekly charts, which is bullish in nature. Last week, the stock has given the pattern breakout with good volume, so buying momentum can continue for coming days.

Therefore, one can buy in the range of Rs1280-1290 levels for the upside target of Rs1410-1440 levels with a stop loss below Rs1,230.

Dewan Housing Finance Corporation Limited (DHFL): BUY | Target Rs 680| Stop Loss Rs 570| Time 1-2 months| Return 11%

The stock closed at 614.15 on 12th January 2018. It made a 52-week low at 264.10 on 13th January 2017 and a 52-week high of 679 on 03rd November 2017.

The 200-days Exponential Moving Average (EMA) of the stock on the daily chart is currently at 511.64. After registering an all-time high, stock consolidated in the range of Rs570-620 levels for five weeks and was forming a “Continuation Triangle” on the weekly charts, which is a bullish pattern.

Last week, the stock has given the breakout of pattern and also has managed to close above the same. On the indicators front, RSI and MACD are also showing strength at current levels.

Therefore, one can buy in the range of Rs600-608 levels for the upside target of Rs670-680 levels with a stop loss below Rs570.

Analyst: Sameet Chavan, Chief Analyst- Technical & Derivatives, Angel Broking Pvt Ltd

Container Corporation : BUY | Target Rs 1524| Stop Loss Rs 1390| Time 5-10 sessions| Return 6%

Finally, after a long consolidation of nearly three months, the stock prices managed to surpass the ‘Horizontal Line’ resistance at Rs 1400 along with sizable volumes.

This was followed by some modest profit booking for a couple of days. However, the way stock prices rebounded precisely after retesting the Rs 1400 mark on Friday, we expect the stock to resume its upward trajectory in days to come.

Thus, we recommend buying this stock for a target of Rs 1524 over the next 5 – 10 sessions. The stop loss should be fixed at Rs 1390

Indo Count Industries: BUY | Target Rs 144| Stop Loss Rs 129.50| Time 9%

Last week, the stock prices broke out from its recent congestion zone around 130, indicating short-term reversal for the stock. This price action was accompanied by a significant rise in volumes, which is a sign of strong buying interest.

Although the stock came off a bit in last two days, we expect the stock to extend this rally by looking at the ‘RSI-Smoothened’ continuing its upward trajectory well above the 70 mark.

The momentum traders can look to place their bets for a short-term target of Rs 144. The stop loss should be fixed at Rs 129.50.

Voltas: SELL| Target Rs 612| Stop Loss Rs 644| Time 5-10 sessions| Return 3%

This stock has been enjoying its stellar run since last twelve months and has clocked new record highs. Undoubtedly, the longer term outlook remains strongly bullish as the overall structure looks quite sturdy.

But, with a near-term view; there are some early signs of exhaustion. Since the last couple of weeks, we have been recommending going short at higher levels.

The stock remained under pressure and has broken down from its important near-term support of 640. Thus, we continue to recommend selling for a short-term target of Rs 612. The stop loss now should be fixed at Rs 644.

Analyst: Sumeet Bagadia Associate Director Choice Broking

Glenmark Pharmaceuticals: BUY| Target Rs 750| Stop Loss Rs 580| Return 20%

On a daily chart, the stock has given a breakout of its neckline of inverse Head & Shoulder pattern which can be considered as bullish reversal formation and indicates upside movement in the counter.

Moreover, the stock has given a breakout of its upper band of falling wedge formation with above-average volume which indicates a robust upside movement in the counter.

Furthermore, the stock has started to trade above its 100-days moving average (DMA) which is placed at a Rs592.10 level which shows that the trend has changed to up from down.

Apart from this, the stock has formed a positive crossover of 21 and 50 weeks moving average which can be considered as bullish crossover which shows positive momentum in the stock.

Analyst: Jay Purohit - Technical & Derivatives Analyst, Centrum Broking Limited

RCF: BUY| Target Rs150| Stop Loss Rs85| Time 3-4 months| Return 42%

The stock is moving in a sideways direction and is making 'Lower Highs Higher Lows' on the monthly chart. The consolidation phase of last ten years has resulted in the formation of a 'Symmetrical Triangle' pattern on the monthly time frame.

Currently, we are witnessing a breakout from the mentioned pattern with decent volume (see exhibit), which is a positive sign for the stock.

Momentum oscillator such as ‘RSI’ and ‘MACD’ too are supporting the bullish argument on the counter. Thus, traders are advised to buy the stock at the current juncture and on declines to Rs103 for a target price of Rs142 - 150 in the coming 3-4 months. The stop-loss for the trade set-up should be placed at Rs85 on a closing basis.

Bata India: BUY | Target Rs 960| Stop Loss Rs 685| Time few weeks| Return 29%

After a decent rally from Rs507.60 to Rs832.80, the stock has started moving in a corrective phase from the last couple of months.

The fall got arrested around the 38.20 percent retracement level of the above-mentioned rally and the stock has started rebounding piercingly.

We witnessed a formation of a couple of ‘Doji’ candles on weekly chart around the support levels, which was followed by a positive momentum. The ‘RSI’ oscillator is showing ‘Positive Reversal’ on the weekly chart and thus showing strength in the counter.

Thus, traders are advised to buy the stock at current juncture and on declines to Rs735 for a target price of Rs920 – 960 in the coming weeks. The stop-loss for the trade set-up should be placed at Rs685 on a closing basis.

Titagarh Wagon Ltd: BUY| Target Rs225| Stop Loss Rs157| Time 3-4 months| Return 29%

After a decent rally from Rs 105.55 to Rs 189.70, the stock has seen some correction in the recent past. However, the stock again started rebounding after taking the support of the 38.20 percent retracement level of the mentioned rally.

On the monthly chart, we witnessed a ‘Trendline’ breakout in November 2017 and the prices managed to sustain above the same.

Considering the positive placement of ‘RSI’ and ‘MACD’ oscillator we are expecting a resumption in the uptrend. Hence, short-term investors can buy the stock at current juncture for a target of Rs205 – 225 in the coming quarter. The stop-loss should be kept at Rs157 on a closing basis.

Rallis India Ltd: BUY| Target Rs325| Stop Loss Rs252| Time Few Weeks| Return 23%

The stock is moving in a sideways direction from last few months; wherein we can see a ‘Higher High Higher Low’ sequence on the weekly chart. We witnessed a breakout from the ‘Continuous Inverted Head & Shoulder’ pattern on the weekly time frame.

The volumes have also increased drastically in the ongoing up move, indicates buying interest from stronger hands.

Since momentum oscillators are also placed positively along with a set of moving averages, we are expecting Rs310 –Rs325 levels in coming few weeks. Thus, traders are advised to buy the stock in the zone of Rs260 – 270 with a stop-loss of Rs252 on a closing basis.